International accounts for 2017 (preliminary data) – all analytical comments

In 2017, the current account of the balance of payments recorded a deficit of US$ 616.94 million. The capital account registered a deficit of US$ 30.41 million and the financial account recorded a net capital inflow of US$ 569.77 million. The international investment position amounted to US$ -3,954.33 million in 2017, while the gross external debt of the Republic of Moldova reached US$ 6,973.70 million

Table 1. Main macroeconomic indicators of the Republic of Moldova

|

|

2013

|

2014

|

2015

|

2016

|

2017

|

|

Gross domestic product in current prices, MDl mil.

|

100,510

|

112,050

|

122,563

|

134,937

|

150,369

|

|

Gross domestic product in current prices, US$ mill.

|

7,983

|

7,981

|

6,514

|

6,773

|

8,132

|

|

GDP, physical volume indices, %

|

109.4

|

104.8

|

99.6

|

104.3

|

104.5

|

|

Period average exchange rate, MDL/USD

|

12.5907

|

14.0388

|

18.8161

|

19.9238

|

18.4902

|

|

Personal remittances / GDP, %

|

25.9

|

24.6

|

22.3

|

20.3

|

19.2

|

|

FDI flows (net incurrence of liabilities) / GDP, %

|

3.0

|

4.3

|

3.3

|

1.3

|

2.6

|

Sources: NBM, NBS

Table 2. Contribution of the main components to the evolution of the BOP current account (BPM6)

|

|

2013

|

2014

|

2015

|

2016

|

2017

|

2017 /2016

|

|

|

Contribution

|

|

|

% to GDP

|

p. p.

|

|

Current account

|

-6.1

|

-7.1

|

-7.2

|

-4.2

|

-7.6

|

-3.4

|

|

Trade balance

|

-37.4

|

-36.6

|

-30.7

|

-27.6

|

-27.7

|

-0.1

|

|

Exports of goods and services

|

38.1

|

37.1

|

38.1

|

38.3

|

38.2

|

0.0

|

|

Imports of goods and services

|

75.5

|

73.7

|

68.7

|

65.9

|

66.0

|

0.1

|

|

Primary income balance

|

11.2

|

10.3

|

6.9

|

6.8

|

6.3

|

-0.5

|

|

Primary income inflow, of which:

|

14.6

|

14.0

|

12.5

|

11.0

|

10.9

|

-0.1

|

|

Compensation of employees

|

14.0

|

13.3

|

12.0

|

10.5

|

10.3

|

-0.2

|

|

Primary income outflow, of which:

|

3.4

|

3.7

|

5.6

|

4.2

|

4.6

|

0.4

|

|

Investment income

|

2.8

|

2.8

|

4.4

|

3.2

|

3.6

|

0.4

|

|

Secondary income balance

|

20.0

|

19.2

|

16.6

|

16.6

|

13.8

|

-2.8

|

|

Secondary income inflow, of which:

|

21.7

|

21.0

|

18.8

|

18.4

|

15.6

|

-2.8

|

|

Personal transfers

|

13.4

|

12.7

|

11.6

|

11.1

|

9.8

|

-1.3

|

|

Current international cooperation

|

3.2

|

4.4

|

3.0

|

3.2

|

2.3

|

-0.9

|

|

Secondary income outflow

|

1.7

|

1.9

|

2.2

|

1.8

|

1.7

|

-0.1

|

|

Capital account

|

1.3

|

1.8

|

0.8

|

-0.3

|

-0.4

|

-0.1

|

|

Net borrowing (current and capital account balance)

|

-4.8

|

-5.3

|

-6.3

|

-4.5

|

-8.0

|

-3.5

|

*percentage points.

Table 3. Sources of coverage for the net borrowing, net financial flows

|

|

2013

|

2014

|

2015

|

2016

|

2017

|

|

% to GDP

|

|

Financial account

|

-3.7

|

-6.3

|

-7.0

|

-3.2

|

-7.0

|

|

Direct investment, of which:

|

-2.6

|

-3.8

|

-3.2

|

-1.1

|

-2.5

|

|

Equity other than reinvestment of earnings

|

-1.0

|

-1.1

|

-0.4

|

-0.5

|

-0.4

|

|

Reinvestment of earnings

|

0.0

|

-0.5

|

-1.9

|

-1.3

|

-1.1

|

|

Debt instruments

|

-1.6

|

-2.1

|

-0.9

|

0.8

|

-1.1

|

|

Portfolio investment and financial derivatives

|

0.0

|

-0.1

|

-0.1

|

0.0

|

0.0

|

|

Other investment, of which:

|

-4.6

|

4.3

|

1.0

|

-9.9

|

-11.0

|

|

Currency and deposits

|

-0.5

|

2.3

|

1.2

|

-5.0

|

-4.9

|

|

Loans

|

-1.9

|

0.6

|

-0.4

|

-1.8

|

-1.4

|

|

Trade credit and advances

|

-1.0

|

-3.3

|

0.1

|

-2.6

|

-4.7

|

|

Other accounts receivable / payable

|

-1.2

|

4.6

|

0.1

|

-0.5

|

0.0

|

|

Change in reserve assets

|

3.5

|

-6.7

|

-4.7

|

7.8

|

6.5

|

Note: (-) – net capital inflow, (+) – net capital outflow

Table 4. Main indicators of the international investment position (BPM6)

|

|

31.12.

2013

|

31.12.

2014

|

31.12.

2015

|

31.12.

2016

|

31.12.

2017

|

31.12.2017 / 31.12.2016 (%)

|

|

Net IIP, US$ mill.

|

-3,146.64

|

-2,807.10

|

-2,963.03

|

-3,034.13

|

-3,954.33

|

130.3

|

|

Stock of foreign assets / stock of foreign liabilities, %

|

64.5

|

66.0

|

60.2

|

60.3

|

55.8

|

-4.5 p.p.

|

|

Stock of direct investment, liabilities, US$ mill.

|

3,472.62

|

3,360.86

|

2,980.08

|

3,037.51

|

3,701.74

|

121.9

|

|

Share of FDI in the stock of foreign liabilities, %

|

39.1

|

40.7

|

40.1

|

39.7

|

41.4

|

1.6 p.p.

|

|

Share of loans (without intercompany loans) in the stock of foreign liabilities, %

|

37.6

|

38.3

|

41.2

|

41.1

|

38.2

|

-2.8 p.p.

|

|

Stock of official reserve assets, US$ mill.

|

2,820.63

|

2,156.63

|

1,756.81

|

2,205.93

|

2,803.26

|

127.1

|

|

Stock of reserve assets / Average monthly actual imports of goods and services (for 12 months), months

|

5.6

|

4.4

|

4.7

|

5.9

|

6.3

|

105.7

|

Note: p. p. – percentage points

*percentage points

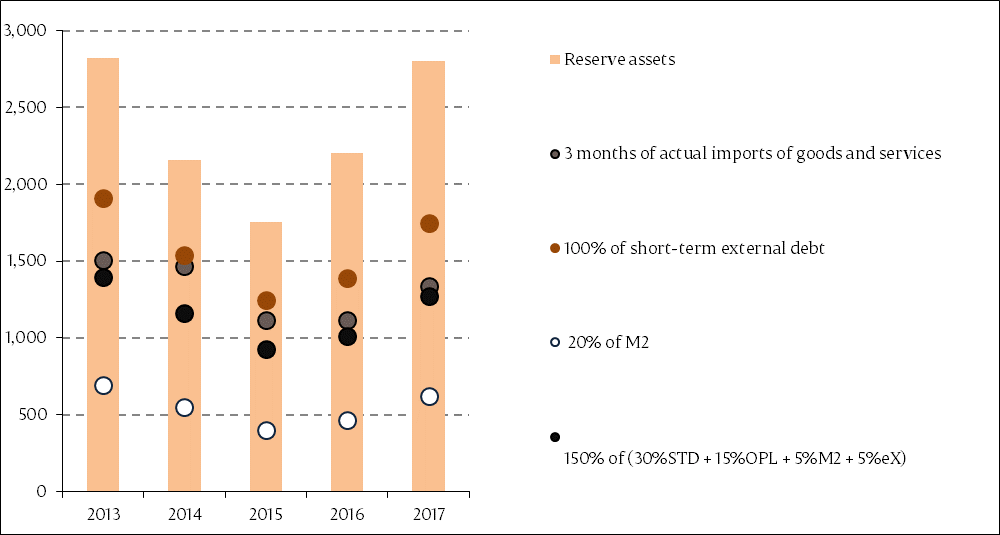

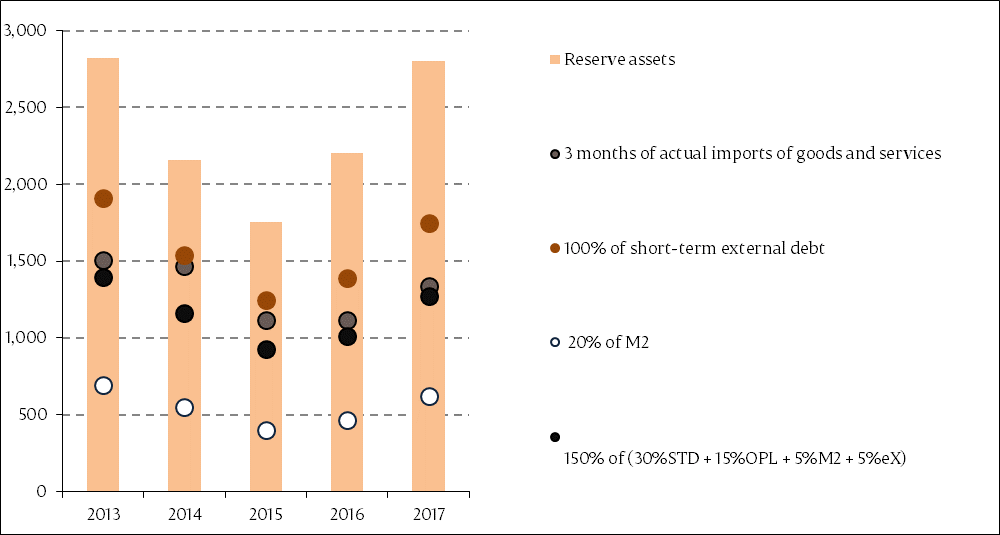

Chart 1. Indices of reserve assets adequacy, at period-end, US$ million

Note: STD – short-term debt, OPL – other portfolio liabilities, M2 – broad money, export-export of goods and services. Criteria are based on the IMF recommendations specified in “Assessing Reserve Adequacy - Specific Proposals", April 2015:

Table 5. Main indicators of the external debt (BPM6)

|

|

31.12.

2013

|

31.12.

2014

|

31.12. 2015

|

31.12.

2016

|

31.12.

2017

|

31.12.2017 / 31.12.2016 (%)

|

|

Gross external debt, US$ mill.

|

6,874.27

|

6,495.79

|

6,104.21

|

6,235.23

|

6,973.70

|

111.8

|

|

Public and publicly guaranteed external debt, US$ mill.

|

1,774.92

|

1,731.05

|

1,702.11

|

1,779.36

|

1,999.63

|

112.4

|

|

Non-guaranteed private debt, US$ mill.

|

5,099.35

|

4,764.74

|

4,402.10

|

4,455.87

|

4,974.07

|

111.6

|

|

Short-term external debt, US$ mill.

|

1,911.50

|

1,541.80

|

1,249.59

|

1,388.59

|

1,747.68

|

125.9

|

|

Long-term external debt, US$ mill.

|

4,962.77

|

4,953.99

|

4,854.62

|

4,846.64

|

5,226.02

|

107.8

|

|

Gross external debt / GDP, %

|

86.1

|

81.4

|

93.7

|

92.1

|

85.8

|

- 6.3 p.p.

|

|

Share of public and publicly guaranteed external debt in gross external debt, %

|

25.8

|

26.6

|

27.9

|

28.5

|

28.7

|

0.1 p.p.

|

|

Share of long-term external debt in gross external debt, %

|

72.2

|

76.3

|

79.5

|

77.7

|

74.9

|

-2.8 p.p.

|

|

Share of international organizations and foreign governments (creditors) in the external debt in the form of loans and SDR allocations, %

|

45.8

|

44.9

|

44.2

|

44.7

|

45.4

|

0.7 p.p.

|

|

Official reserve assets / Short-term external debt, %

|

147.6

|

139.9

|

140.6

|

158.9

|

160.4

|

1.5 p.p.

|

Note: p. p. – percentage points

Details on international accounts evolution (balance of payments, international investment position and external debt) can be found in the analytical materials published on the official website of NBM:

Time series are available starting from:

-

1995 for the balance of payments according to BPM5, 2009 for the balance of payments according to BPM6;

-

1998 for the international investment position according to BPM5, 2012 for the international investment position according to BPM6;

-

2001 for the external debt according to BPM5, 2009 for the external debt according to BPM6.

Interactive database:

Balance of payments (BPM6);

International investment position (BPM6);

External debt (BPM6).