Welcome to the official website of the National Bank of Moldova!

×

Do you have good eyesight and want to turn this tool off?

Welcome to the official website of the National Bank of Moldova!

You can choose one of the most popular reports from the list:

In March 2018, monetary baseThe monetary base includes money in circulation (outside banking system), banking reserves (banks' reserves in MDL on correspondent accounts maintained at the National Bank of Moldova and cash in banks), deposits at sight of other organizations with the National Bank of Moldova, “overnight” deposits of banks and required reserves in foreign currency. increased by MDL 1,854.2 million (5.0 percent) compared to the previous month, and amounted to MDL 39,039.9 million. The increase of the monetary base was determined by the growth of one of its counterparts, namely, net domestic assets, which increased by MDL 1,887.4 million (40.1 percent), whereas net foreign assets decreased by MDL 33.2 million (0.1 percent).

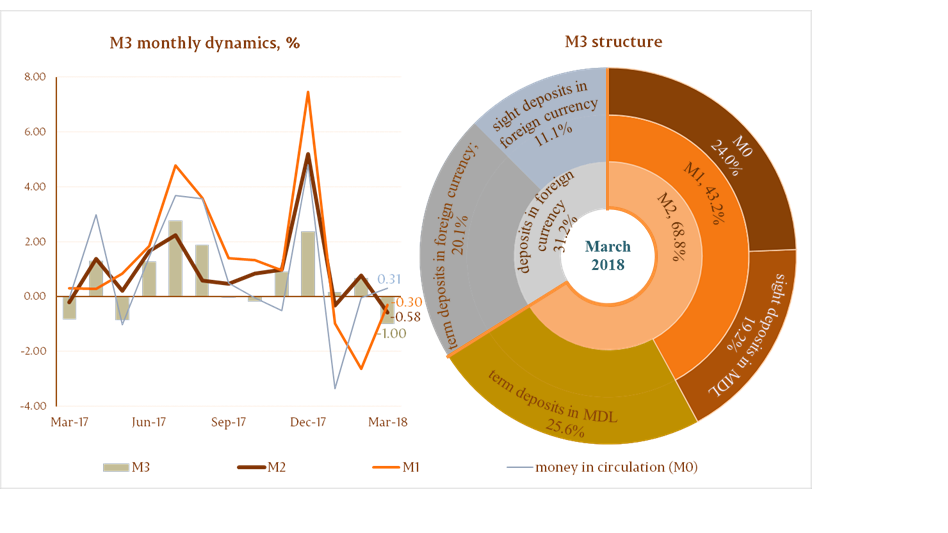

Money supply M2 Money supply M2 includes money in circulation (M0), deposits of residents in MDL and money market instruments.decreased by MDL 310.2 million, or by 0.6 percent compared to February 2018, and recorded MDL 52,914.3 million, having increased by 14.1 percent compared to the same period of the previous year.

Money supply M3 Money supply M3 includes money supply M2 and deposits of residents in foreign currency expressed in MDL.decreased by MDL 774.2 million (by 1.0 percent), having recorded values 9.6 percent higher year-on-year.

The analysis of the Money supply components (M3) shows that its decrease over March 2018 was driven by the decrease in the total deposit balance by MDL 831.8 million, whereas the monetary aggregate money in circulation (M0)Money in circulation M0 represent circulating cash issued by the National Bank of Moldova, except for cash in banks and NBM vault. increased by MDL 57.6 million (Chart 1).

It should be mentioned that monetary aggregates Money in circulation (M0) and Money supply (M1)Money supply M1 includes money in circulation and residents' domestic currency sight deposits. have increased compared to March 2017 by 12.6 and 19.8 percent, respectively.

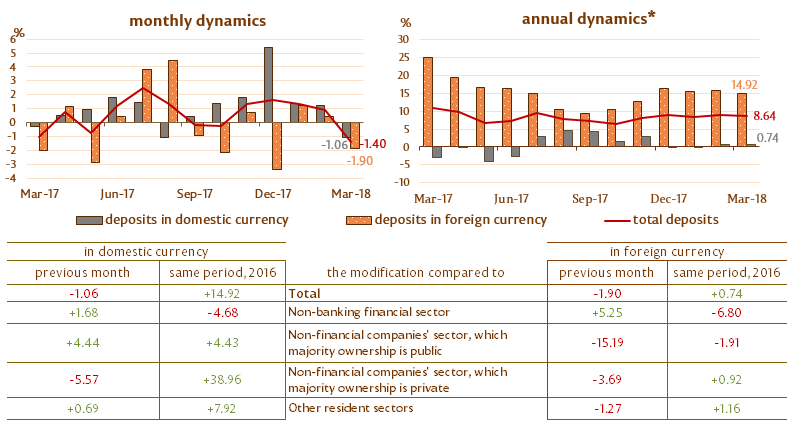

The domestic currency deposit balance has decreased by MDL 367.8 million, having dropped to MDL 34,455.9 million, accounting for a share of 58.9 percent of total deposit balance, whereas the foreign currency deposit balance (recalculated in MDL) decreased by MDL 464.0 million, to MDL 24,004.2 million, accounting for a share of 41.1 percent (Chart 2).

From the perspective of its counterparts, the decrease of Money supply M3 over the reporting period was determined by the decrease in net foreign assetsIs calculated by subtracting foreign liabilities from foreign assets.

Foreign assets include: deposits placed in non-residents insittutions; loans to non-residents; debt securities held (issued by non-residents); non-resident; shares and other equity held by residents, monetary gold.

Foreign liabilities include the resources attracted from non-residents: deposits, debt securities, credits and IMF loans, liabilities for distributed SDRs and other liabilities of the banking system, by MDL 223.4 million (0.3 percent), and the decrease in net domestic assetsis calculated by subtracting domestic liabilities from domestic assets.

Domestic assets include: resident loans; debt securities held (issued by residents); shares and other equity investments held by residents.

Domestic liabilities (excluding components of money supply M3) include the resources attracted from residents: deposits, debt securities with over 2 years’ maturity issued on domestic market; capital and reserves., which dropped by MDL 550.8 (6.3 percent).

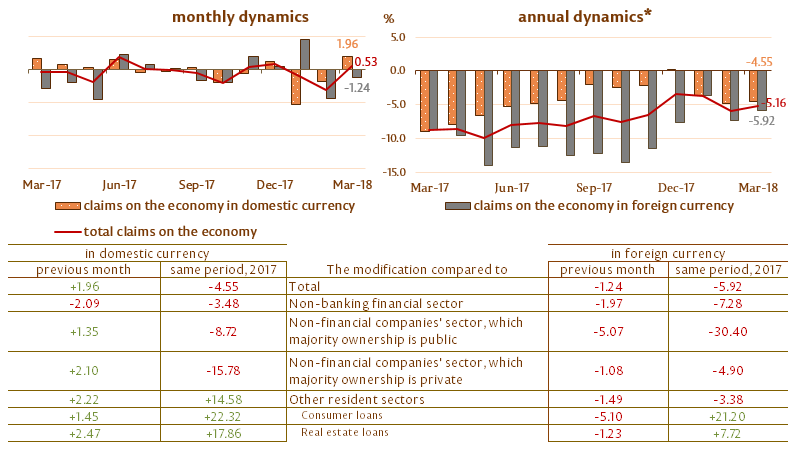

In March 2018, the balance of claims on the economy According to the IMF methodology, non-resident loans, interbank loans and loans extended to the Government of the Republic of Moldova are excluded from the total claims on the economy, (including the interest calculated for credits and for credits of banks - in liquidation process). increased by MDL 192.1 million (0.5 percent) as a result of the growth of domestic currency claims on economy, by MDL 395.5 million (2.0 percent), whereas the foreign exchange claims on economy (recalculated in MDL) have dropped by MDL 203.4 million or .2 percent (Chart 3).

It should be mentioned that foreign exchange claims on economy, expressed in USD, have increased over the reference period by USD 1.2 million (0.1 percent).

The evolution of the balance of domestic currency claims on economy was determined by the increase in balance of claims on such sectors as non-financial commercial companies, which majority ownership is public, non-financial commercial companies, which majority ownership is private ownership and other resident sectors (including individuals) by MDL 11.1 million (1.4 percent), 215.1 million (2.1 percent), and 184.7 million (2.2 percent), respectively. At the same time, the balance of claims on the non-banking financial sector has decreased by MDL 15.4 million (2.1 percent).

The decrease of balance of foreign exchange claims on the economy (expressed in MDL) was determined by the decrease in balance of claims on all sectors as follows: on non-financial commercial companies, which majority ownership is public, by MDL 23.3 million (5.1 percent), on non-financial commercial companies, which majority ownership is private, by MDL 159.9 million (1.1 percent), on the non-banking financial sector and other resident sectors (including individuals), by MDL 15.4 million (2.0 percent) and MDL 4.8 million (1.5 percent), respectively.

* change recorded against the values of the same period of the previous year