Welcome to the official website of the National Bank of Moldova!

×

Do you have good eyesight and want to turn this tool off?

Welcome to the official website of the National Bank of Moldova!

You can choose one of the most popular reports from the list:

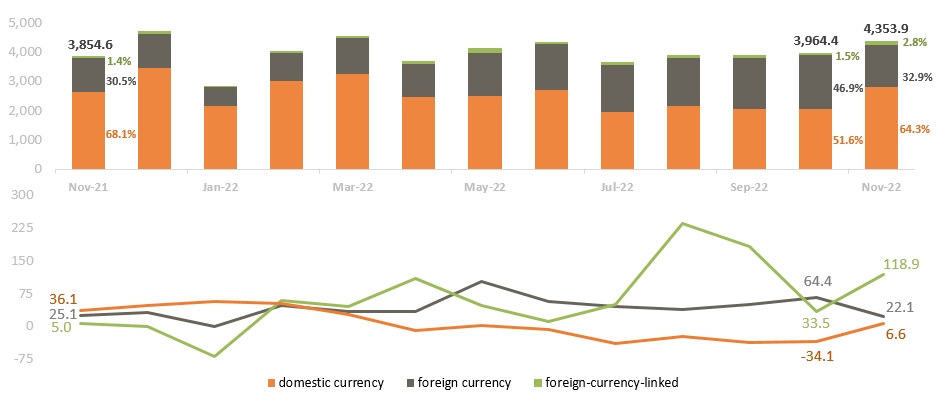

In November 2022, new loans extended1 by banks totaled MDL 4,353.9 million, increasing by 13.0% compared to November 2021.

The structure of loans granted (Chart 1) in the reporting month evolved as follows:

Chart 1

Dynamics of new loans extended, million MDL (upper chart) and the annual growth rate of new loans extended by banks, % (lower chart)

Source: NBM report on average rates and volumes of new loans and new deposits attracted for November 2022.

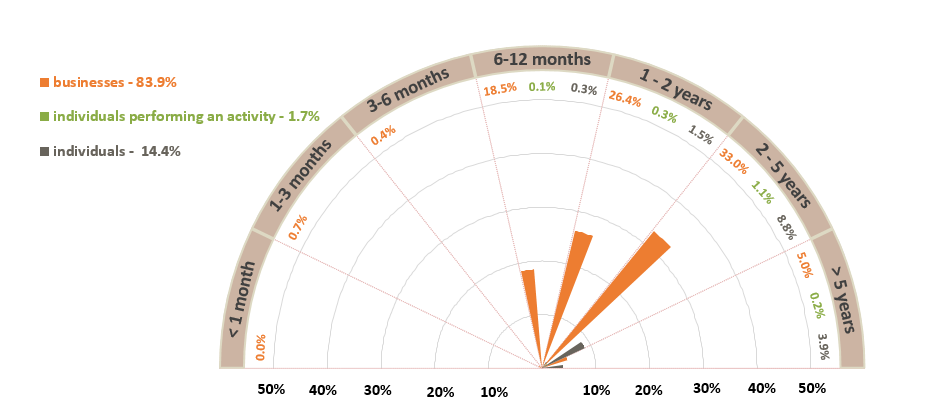

In terms of maturity (Chart 2), loans with maturity ranging from 2 to 5 years recorded the highest demand, with a share of 42.9%. The share of businesses’ loans extended to legal entities accounted for 33.0% in the total amount of extended loans.

Chart 2

New loans extended by maturity and their structure, %

Source: NBM report on average rates and volumes of new loans and new deposits attracted for November 2022.

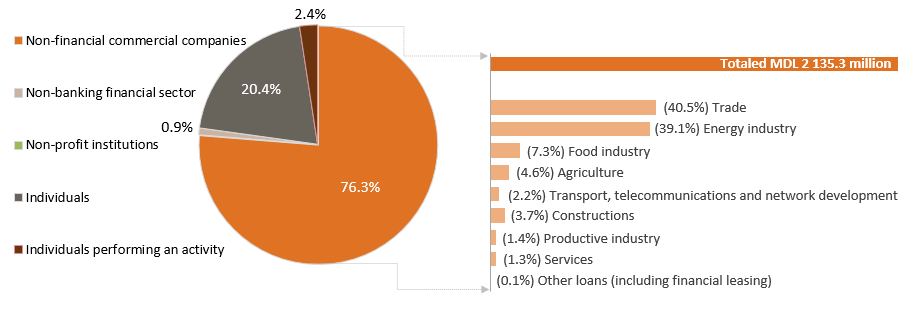

Domestic currency loans (Chart 3) were mainly represented by loans extended to non-financial commercial companies (76.3%) and to individuals (20.4%). Within loans to non-financial commercial companies, loans to trade dominated (40.5%).

Chart 3

Domestic currency loans by sectors, %

Source: NBM report on average rates and volumes of new loans and new deposits attracted for November 2022.

Foreign currency loans were mainly requested by non-financial commercial companies (94.3%), and the largest share (61.2%) belonged to trade.

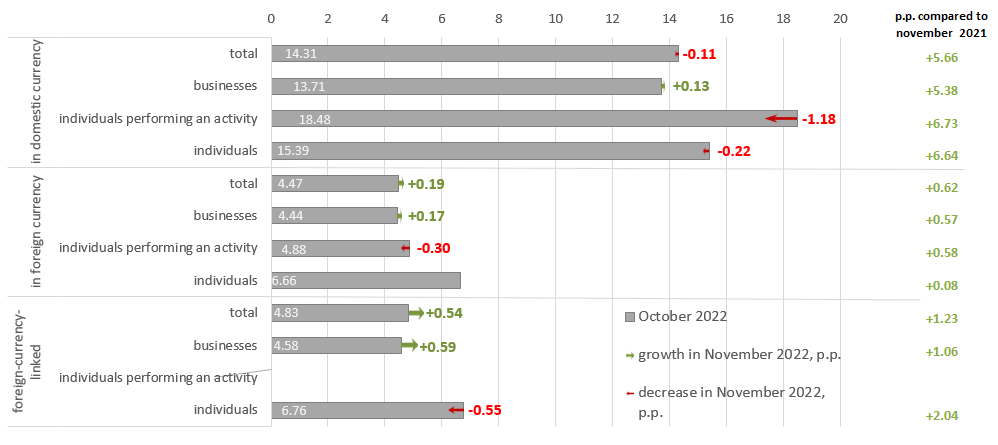

The average nominal interest rate on new loans extended in domestic currency constituted 14.20%, on loans in foreign currency – 4.66%, and on foreign-currency-linked loans – 5.37%.

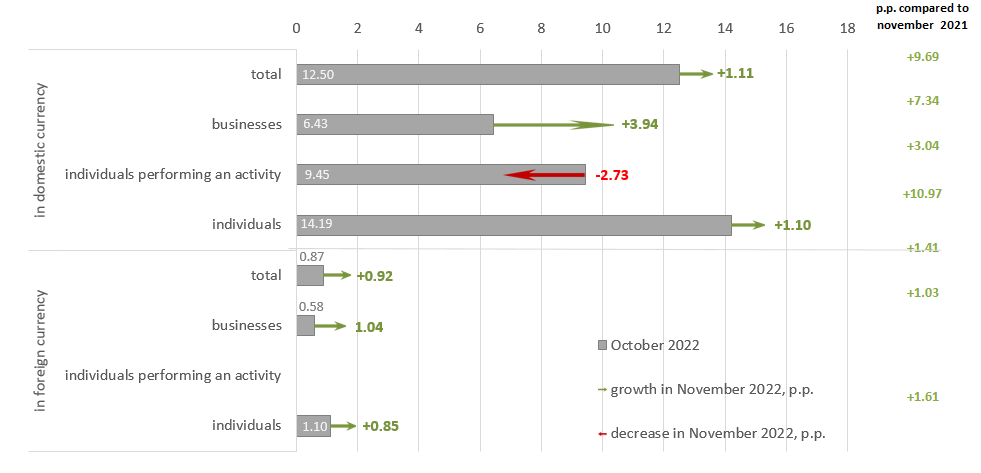

Compared to the previous month, the average rate evolved as follows (Chart 4):

Compared to the similar period of the previous year, the weighted average nominal interest rate on domestic currency loans increased by 5.65 p.p., on those in foreign currency – by 0.62 p.p., and on foreign-currency-linked loans – by 1.23 p.p.

Chart 4

Weighted average nominal interest rates on new loans, %

Source: NBM report on average rates and volumes of new loans and new deposits attracted for November 2022.

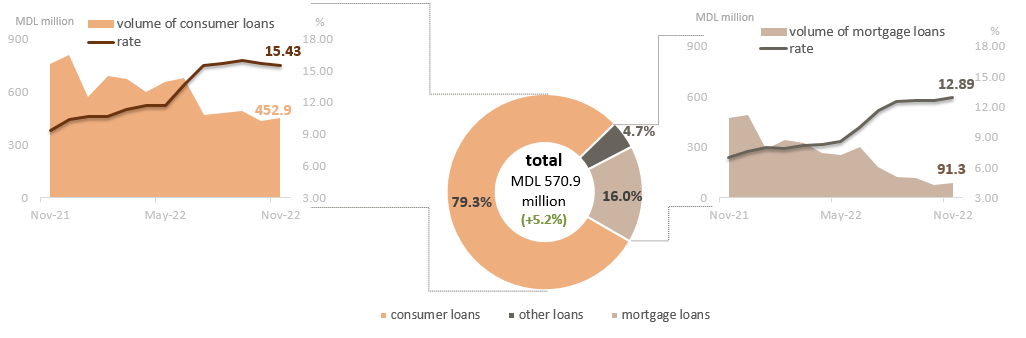

The volume of domestic currency loans extended to individuals increased in November 2022 by 5.2%,, as compared to the previous month, and totaled MDL 570.9 million (Chart 5). The average rate on these loans decreased by 0.22 p.p.

Chart 5

Domestic currency loans extended to individuals

Source: NBM report on average rates and volumes of new loans and new deposits attracted for November 2022.

From the perspective of the purpose of loans extended to individuals, consumer loans held the largest share (79.3%), and were extended at an average rate of 15.43% (-0.27 p.p. compared to the previous month and +6.05 p.p. compared to November 2021).

The average rate on mortgage loans extended in domestic currency decreased by 0.29 p.p. compared to the previous month and by 5.88 p.p. compared to November 2021 and totaled 12.89%.

It should be noted, that 63.4% of total mortgage loans were extended in domestic currency. Consumer loans also were mainly extended in domestic currency (99.7% of total consumer loans).

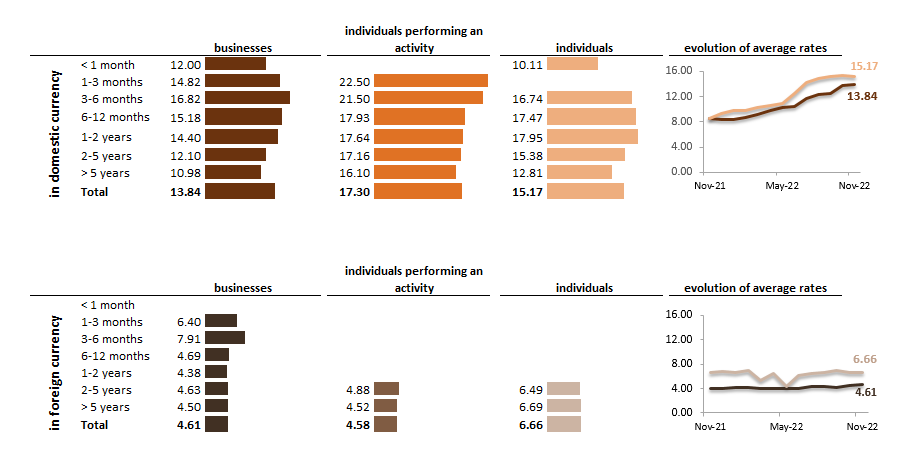

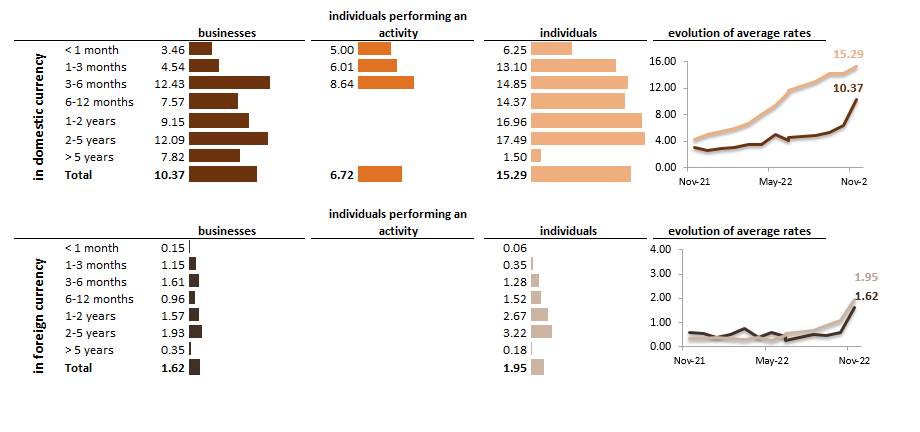

Domestic currency loans (Chart 6) with maturity from 2 to 5 years (MDL 1,091.6 million, recording the highest demand in the reporting month) were extended at an average interest rate of 13.45% (12.10% – on businesses loans, 17.16% – on individuals performing an activity loans, and 15.38% – on individuals’ loans).

Chart 6

Average rates on extended loans, by maturity, %

Source: NBM report on average rates and volumes of new loans and new deposits attracted for November 2022.

The highest average rate on domestic currency loans was registered on loans with maturity from 3 to 6 months and amounted to 17.17%.

Loans in foreign currency with terms of 2 to 5 years (MDL 755,6 million, which had the highest volume in the reporting month) were extended at an average rate of 4.64%, businesses loans – 4.63% (MDL 750,7 million), individuals received their loans at a rate of 6.49% (MDL 3.6 million), and individuals performing an activity received their loans at an average rate of 4.88% (MDL 1.3 million) (Chart 6).

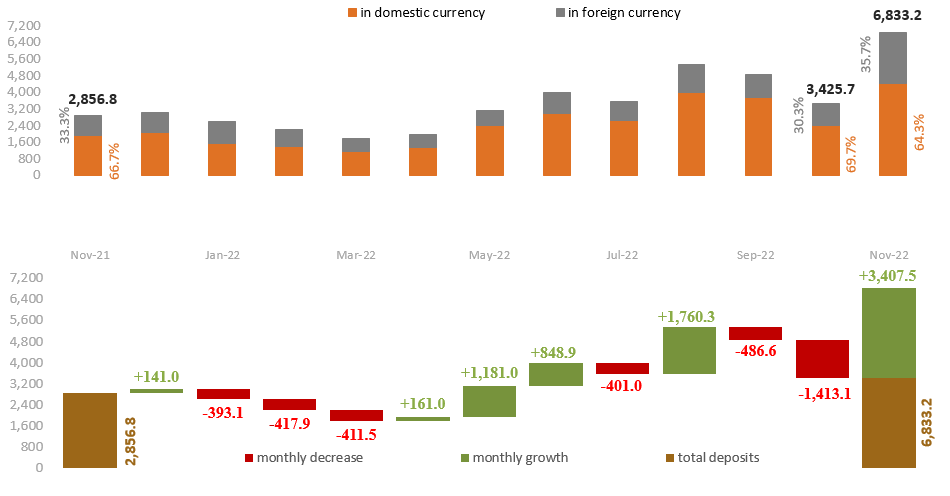

In November 2022, the new term deposits totaled MDL 6,833.2 million, increasing by 2.4 times as compared to November 2021 (Chart 7).

Chart 7

Dynamics of term deposits (upper chart) and change from the previous month (lower chart), million MDL

Source: NBM report on average rates and volumes of new loans and new deposits attracted for November 2022.

The volume of new term deposits constituted:

The share of deposits attracted in domestic currency constituted 64.3%, of those in foreign currency – 35.7%.

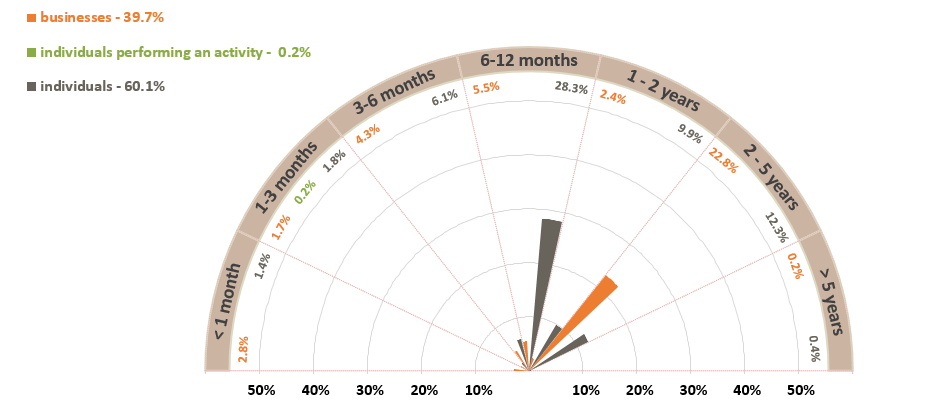

Individuals’ deposits (Chart 8) represented the largest share of total deposits - 60.1% (where 42.4% represents domestic currency deposits and 17.7% – foreign currency deposits).

Chart 8

New term deposits placed by maturity and their structure, %

Source: NBM report on average rates and volumes of new loans and new deposits attracted for November 2022.

In terms of maturity, the highest demand was recorded for deposits with terms from 2 to 5 years, which held 35.0% of total term deposits. Businesses’ deposits attracted at this term accounted for 22.8% of the total of deposits.

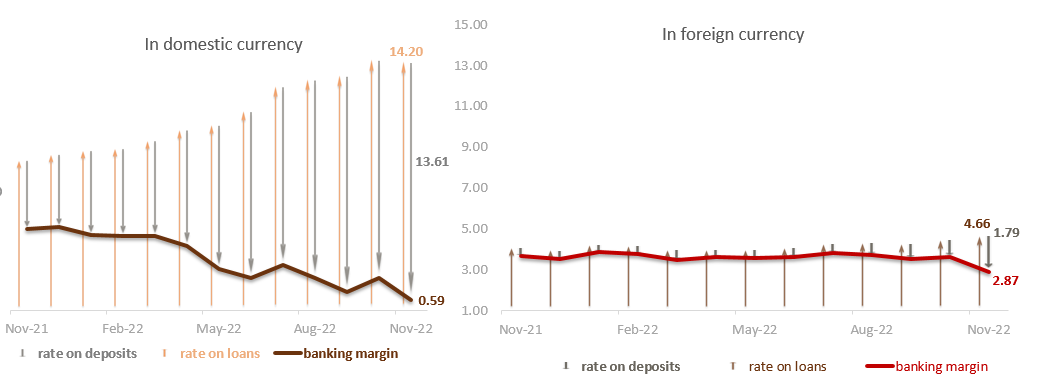

The average interest rate on domestic currency term deposits constituted 13.61%, and on those in foreign currency – 1.79%.

Chart 9

Weighted average rates on new term deposits, %

Source: NBM report on average rates and volumes of new loans and new deposits attracted for November 2022.

Compared to the previous month, the average rate evolved as follows:

Compared to November 2021, the average interest rate on domestic currency deposits increased by 9.69 p.p., but that on foreign currency deposits – by 1.41 p.p. (Chart 9).

Chart 10

Average interest rates on new term deposits, by maturity, %

Source: NBM report on average rates and volumes of new loans and new deposits attracted for November 2022.

Domestic currency deposits with maturity from 6 to 12 months, holding the highest share (35.7% of total deposits in domestic currency), were attracted at an average interest rate of 13.42% (businesses’ deposits were attracted at an average rate of 7.57%, while individuals’ deposits – at a rate of 14.37%). Individuals performing an activity did not place domestic currency deposits with maturity from 6 to 12 months (Chart 10).

In the case of foreign currency deposits, the largest share (46.0%) is held by those with terms from 2 to 5 years, which were placed at an average interest rate of 2.26% (businesses placed their deposits at a rate of 1.93%, individuals – at a rate of 3.22%).

The highest average rate on domestic currency deposits was recorded as follows:

The highest average rate on foreign currency deposits was recorded as follows:

Interest rate margin on domestic currency transactions constituted 0.59 p.p., while on those in foreign currency amounted to 2.87 p.p.

Chart 11

Bank interest margin, p.p.

Source: NBM report on average rates and volumes of new loans and new deposits attracted for November 2022.

The interest rate margin on operations in domestic currency decreased by 1.22 p.p. compared to the previous month and by 4.03 p.p. as compared to November 2021 (Chart 11).

The interest margin on foreign currency transactions decreased by 0.73 p.p. compared to the previous month and by 0.79 p.p. as compared to November 2021.

1. Data presented according to Instruction on preparation and presentation of reports on interest rates applied by banks in the Republic of Moldova, approved by Decision of the Executive Board of the NBM No 331 of 1 December 2016, Official Monitor of the Republic of Moldova No 441-451 of 16 December 2016, as subsequently amended and supplemented.

2. Loans foreign-currency-linked, according to the Regulation on the open currency position of the bank, approved by Decision of the Council of Administration of the National Bank of Moldova No 126 of 28.11.1997, Official Monitor of the Republic of Moldova No 112-114/198 of 14.10.1999, with further modifications and completions, refer to the assets which balance, according to the conditions established in the relevant contracts concluded by the bank, shall be modified depending on the evolution of the exchange rate of Moldovan currency against the attached exchange rate.

3. Individuals performing an activity, in accordance with the Instruction on completion by licensed banks of the Report on monetary statistics, approved by the Decision of the Executive Board of the NBM No 255 of 17 November 2011, Official Monitor of the Republic of Moldova No 206-215 of 2 January 2011, as subsequently amended and supplemented, work in associations without legal personality and are producers of goods and/or services for market, and namely, individual enterprises, farms, entrepreneur license holders, notaries, lawyers, bailiffs, etc.