Bine ați venit pe pagină oficială a Băncii Naționale a Moldovei!

×

Ai vederea bună și dorești să închizi acest instrument?

Ai vederea bună și dorești să închizi acest instrument?

Anca Dragu, guvernator

Vladimir Munteanu, prim-viceguvernator

A doua zi de miercuri a lunii: 14:00-16:00.

Telefon: +373 22 822 606.

Tatiana Ivanicichina, viceguvernator

A treia zi de miercuri a lunii: 14:00-16:00.

Telefon: +373 22 822 607.

Constantin Șchendra, viceguvernator

A patra zi de miercuri a lunii: 14:00-16:00.

Telefon: +373 22 822 607.

Bine ați venit pe pagină oficială a Băncii Naționale a Moldovei!

Dacă doriţi să expediaţi un mesaj (întrebare sau sugestie) în regim on-line accesați compartimentul "Feedback" din meniul principal din partea de sus a site-ului.

Cele mai populare rapoarte statistice:

Banca Naţională şi membrii organelor de conducere ale acesteia sunt independenţi în exercitarea atribuţiilor stabilite de lege şi nu pot solicita şi nici accepta instrucţiuni de la autorităţile publice sau de la orice altă autoritate.

Banca Naţională informează publicul despre evoluția inflației anuale, strategia de politică monetară,rezultatele analizei macroeconomice, evoluţiei pieţei financiare şi informaţia statistică, inclusiv privind masa monetară, acordarea creditelor, balanţa de plăţi şi situaţia pieţei valutare.

Pentru asigurarea şi menţinerea stabilităţii preţurilor pe termen mediu, Banca Naţională a Moldovei menţine inflaţia (măsurată prin indicele preţurilor de consum) la nivelul de 5.0 la sută anual cu o posibilă abatere de ± 1.5 puncte procentuale, fiind considerat nivelul optim pentru creşterea şi dezvoltarea economică a Republicii Moldova pe termen mediu.

Stabilitatea financiară se realizează prin consolidarea rezilienței sistemului financiar, limitarea efectului de contagiune și diminuarea acumulării de riscuri sistemice, contribuind, astfel, la sustenabilitatea sectorului financiar și creșterea economică.

Banca Naţională a Moldovei, are dreptul exclusiv de a emite pe teritoriul Republicii Moldova bancnote şi monede metalice ca mijloc de plată. BNM pune în circulaţie bancnote şi monede metalice, prin intermediul sistemului bancar.

Banca Naţională este unica instituţie care efectuează licenţierea, supravegherea şi reglementarea activităţii instituţiilor financiare.

Banca Națională supraveghează sistemul de plăţi în Republica Moldova şi promovează funcţionarea stabilă şi eficientă a sistemului automatizat de plăţi interbancare.

Banca Naţională este o persoană juridică publică autonomă şi este responsabilă faţă de Parlament.

BNM publică statistici privind masa monetară, sectorul bancar, balanța de plăți, situația pieței valutare, etc. pentru a asigura transparența în procesul de elaborare și adoptare a deciziilor BNM, a asigura continuitatea în comunicare și predictibilitatea BNM pe piață, pentru sporirea credibilității BNM în calitate de bancă centrală dar și pe piața financiar-bancară din Republica Moldova.

Site-ul www.bnm.md prioritizează securitatea datelor și utilizează cookie-urile pentru îmbunătățirea experienței de navigare și confortul utilizatorului. Acceptul folosirii cookie sporește viteza de lucru a paginii și garantează funcționarea normală a modulelor de prezentare a informațiilor. Refuzul folosirii cookie poate încetini încărcarea site-ului și îngreuna navigarea lină între pagini. Mai multe detalii în Politica de utilizare a cookie-urilor.

In February 2022, the monetary base1 decreased by MDL 706.1 million (1.2%) compared to the previous month and amounted to MDL 56,743.2 million, being 1.2 percent higher than in February 2021.

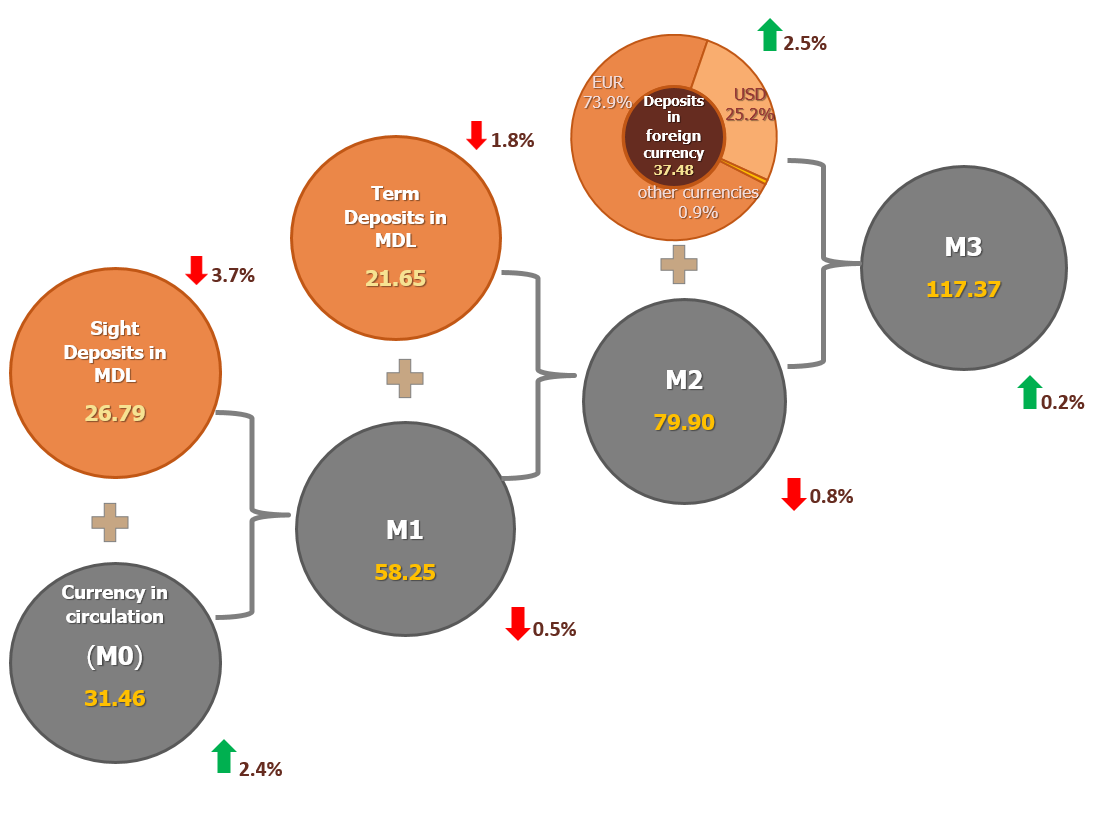

Money supply M02 (currency in circulation) increased by MDL 725.7 million or by 2.4 percent compared to January 2022 and amounted MDL 31,461.4 million, by 3.3 percent more than in February 2021 (chart 1).

Chart 1.

The evolution of the money supply in February 2022 compared to the previous month, billion MDL3

Money supply M14 decreased by MDL 290.3 million or by 0.5% compared to January 2022 and amounted MDL 58,246.6 million, being 4.3% higher than in the similar period of the previous year.

Money supply M25 decreased by MDL 684.7 million or by 0.8% compared to January 2022 and amounted to MDL 79,894.0 million, by 4.3% more than in the similar period of the previous year.

Money supply M36 increased by MDL 244.4 million (0.2%) compared to January 2022 and amounted MDL 117,371.7 million, being 8.6 percent higher than in February 2021.

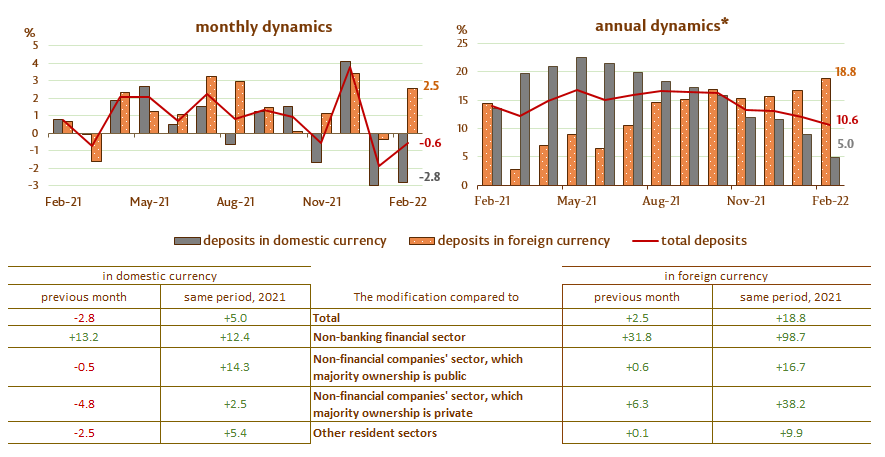

Chart 2.

Dynamics of bank deposits7, %

* modification as compared to the similar period of the previous year.

The balance of deposits in domestic currency decreased by MDL 1,410.5 million compared to the previous month and amounted to MDL 48,432.6 million, representing a share of 56.4% of the total balance of deposits. At the same time, the balance of deposits in foreign currency (recalculated in MDL) increased by MDL 929.1 million, up to the level of MDL 37,477.7 million, having a share of 43.6% (chart 2).

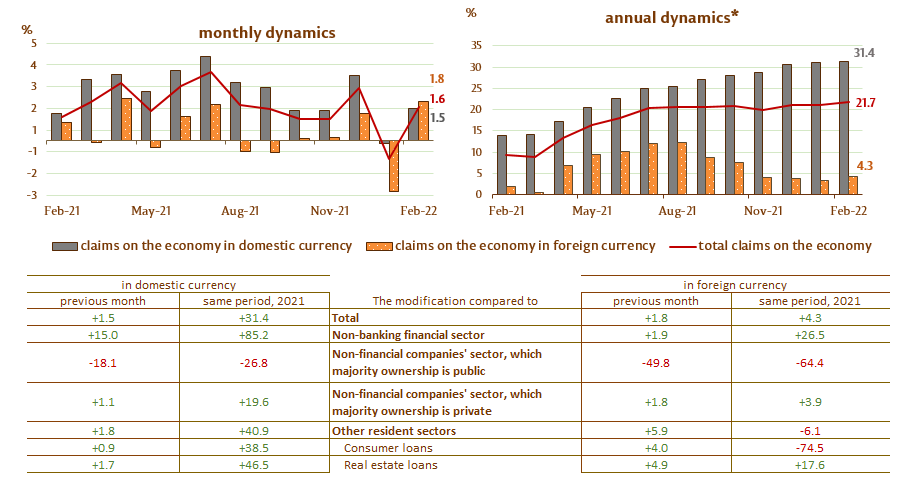

Balance of claims on the economy8 amounted to MDL 59,439.9 million and increased by MDL 924.0 million (1.6%) in the reporting month, as a result of the increase of claims on economy in domestic currency by MDL 600.4 million (1.5%) and claims on economy in foreign currency (expressed in MDL) by MDL 323.6 million (1.8%) (chart 3).

It should be noted, that claims on the economy in foreign currency, expressed in USD, increased during the reference period by USD 3.9 million (0.4%).

The increase in the balance of claims on the economy in the domestic currency was determined by the increase of claims on other resident sectors (including individuals) by MDL 421.0 million (1.8%), claims on non-financial commercial companies, which majority ownership is private by MDL 166.0 million (1.1%), and the balance of claims on the non-banking financial sector by MDL 125.3 million (15.0%). At the same time, balance of claims on non-financial commercial companies, which majority ownership is public decreased by MDL 112.0 million (18.1%).

Chart 3.

Dynamics of claims on economy

* modification as compared to the similar period of the previous year.

The increase in the balance of claims on the economy in foreign currency (expressed in MDL)3 was determined by the increase in the balance of claims on the non-financial commercial companies, which majority ownership is private by MDL 299.3 million (1.8%), the balance of claims on other resident sectors (including individuals) by MDL 28.3 million (5.9%), and the balance of claims on non-banking financial sector by MDL 17.9 million (1.9%). At the same time, the balance of claims on non-financial commercial companies which majority ownership is public decreased by MDL 21.9 million (49.8%).

1. Broad monetary base includes cash money released by the National Bank of Moldova (except for cash in bank’s vault), bank’s reserves in MDL ( held in correspondent accounts at the National Bank of Moldova), foreign currency obligatory reserves, overnight deposits of banks and sight deposits of other organisations at the National Bank of Moldova.

2. Money in circulation M0 represent cash released by the National Bank of Moldova, except for cash in bank’s safes and in the vault of the National Bank of Moldova.

3. Money supply M1 includes money in circulation (M0) and sight deposits of residents in domestic currency.

4. Money supply M2 includes monetary aggregate (M1), term deposits of residents in domestic currency and money market instruments.

5. Money supply M3 includes money supply M2 and deposits of residents in foreign currency expressed in Moldovan lei

6. The deposits are structured on institutional sectors, under the Guidelines on the completion by licensed banks of the Report on monetary statistics (Official Monitor of the Republic of Moldova no.206-215 of 2 December 2011). Other resident sectors include the sectors of households (individuals, individuals conducting business) and non-profit institutions serving households.

7. According to the IMF methodology, the credits of non-residents, interbank credits and the credits issued by the Government of the Republic of Moldova have been excluded from the total claims on economy (including the interest rate calculated for the credits of banks under liquidation).

Bulevardul Grigore Vieru nr. 1,

MD-2005, Chişinău, Republica Moldova

© 2023 Banca Națională a Moldovei

Condiții de utilizare