Welcome to the official website of the National Bank of Moldova!

×

Do you have good eyesight and want to turn this tool off?

Welcome to the official website of the National Bank of Moldova!

You can choose one of the most popular reports from the list:

In 2017, the total volume of money transferred to individuals, residents of the Republic of Moldova, amounted to USD 1,199.97 million. It should be mentioned that a share of 85.2 percent of money was transferred via money remittance systems (in USD, EUR and RUB), mainly without opening bank accounts, whereas 14.8 percent represented bank transfers (in different currencies) carried out via the SWIFT system, presented in gross settlements.

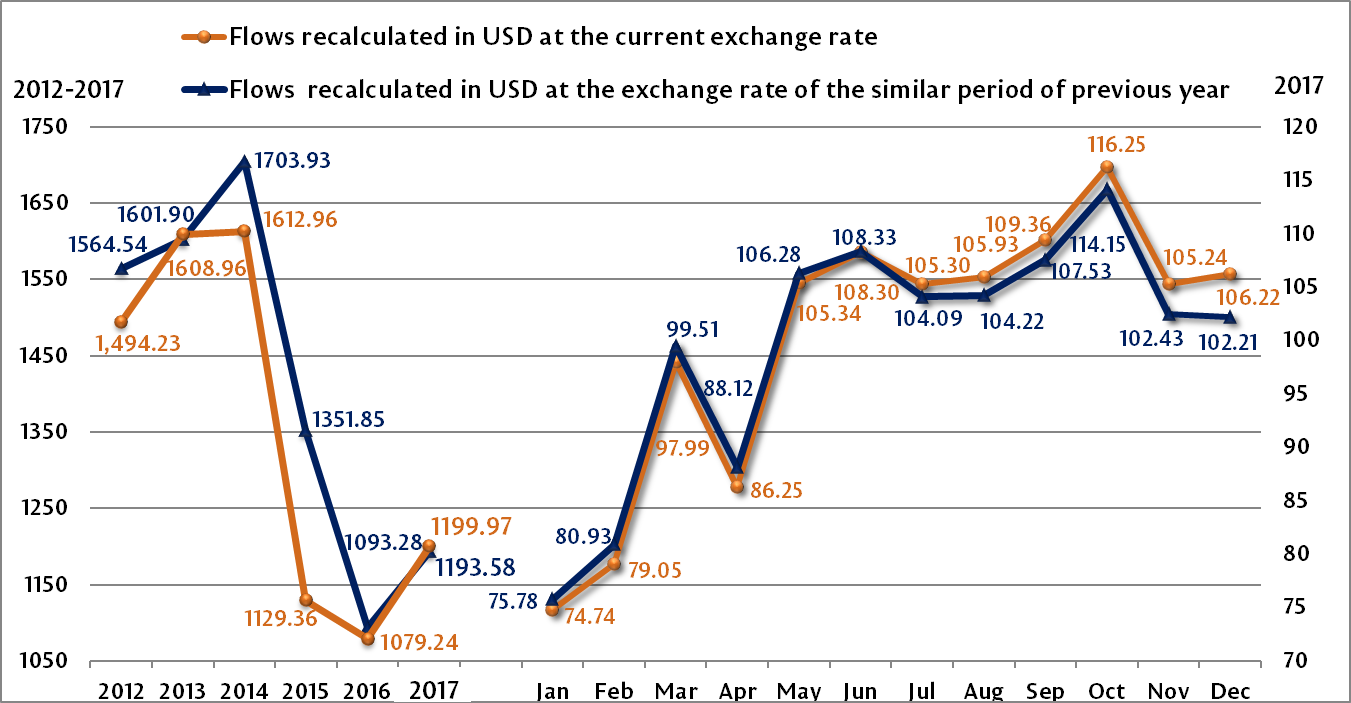

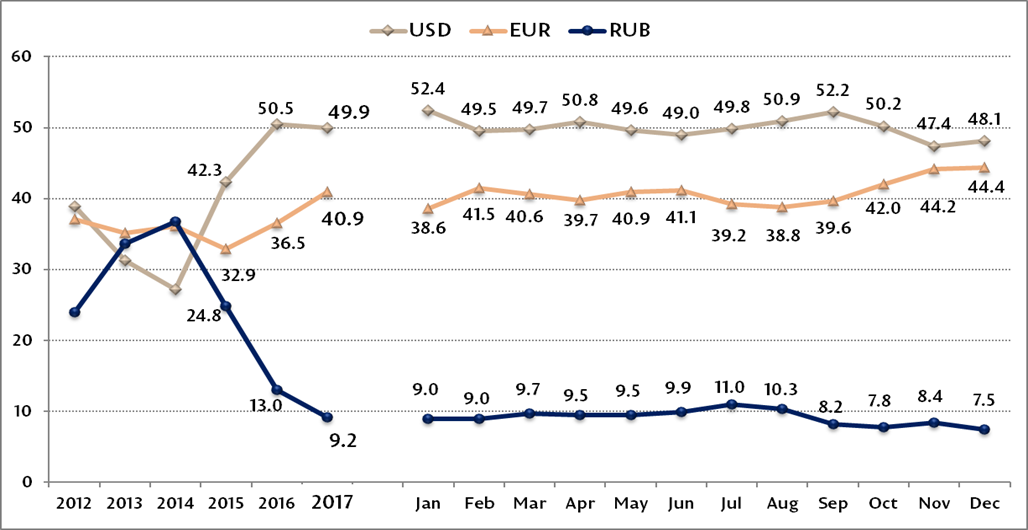

The total amount of money transfers made in USD increased in 2017 by 11.2 percent compared to 2016 (USD 1,079.24 million), including by 0.6 percentage points as a result of the appreciation of EUR and RUB against USD (according to the NBM daily official exchange rates). The real increase of total transfers represented 10.6 percent. This was due to the impact of the increase in EUR transfers by 21.9 percent and the decline in RUB transfers by 20.4 percent. Thus, in 2017, the currency structure of money transfers (recalculated in USD) was as follows: USD - 570.54 million, EUR - 522.37 million, RUB - 94.40 million and other currencies - 12.66 million. Chart no. 1 presents the impact of the developments of USD/EUR and USD/RUB exchange rates on monthly money transfers to individuals in 2017.

Chart no. 1. The evolution of USD/EUR and USD/RUB exchange rate impact on total transfers made in 2017, USD million

SOURCE: International banking operations statistics of the NBM

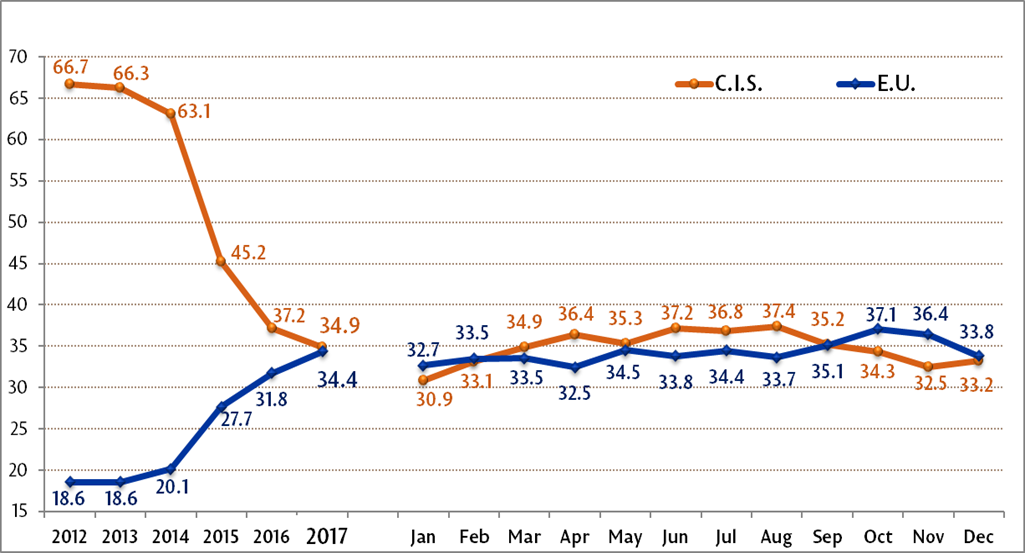

During 2012-2017, the money transfers to individuals from the CIS countries recorded a downward trend, while those from the EU, on the contrary, recorded an upward trend (Chart no. 2). Thus, during the reference period, the money transfers to individuals from these two economic areas recorded relatively equal shares. The CIS money transfers totaled 34.9 percent, increasing by 4.3 percent compared to 2016. The EU money transfers recorded a share of 34.4 percent, increasing by 20.3 percent as compared to 2016. It should be noted that during 2012 - 2017, as in monthly dynamics during 2017, the shares of money transfers from the CIS and the EU recorded an obvious negative correlation (Chart no. 2). Money transfers from other states, except for the CIS and the EU, totaled 30.7 percent in 2017 and 31.0 percent in 2016. In 2017 and 2016, money transfers from Israel, the USA and Turkey accounted for 85.5 percent and 82.5 percent, respectively, of the total money transfers from other states.

Chart no. 2. Dynamics of transfers from CIS and EU in to of individuals (2012 - 2017 annual dynamics; 2017 monthly dynamics), %

SOURCE: International banking operations statistics of the NBM

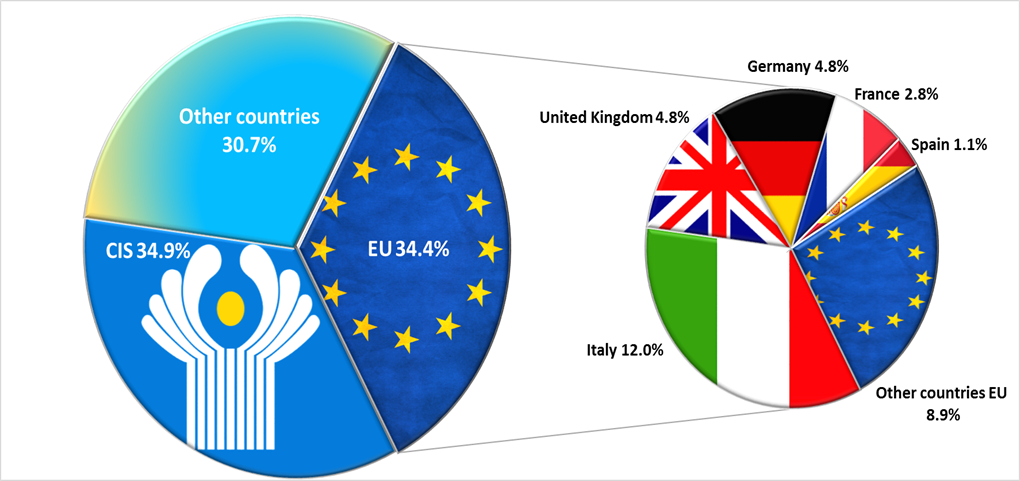

The money transfers from CIS mainly come from Russia, accounting for a share of 96.2 percent. Money transfers from other CIS countries have recorded the following shares: Ukraine - 1.3 percent, Kazakhstan - 1.0 percent, Belarus - 0.5 percent, Azerbaijan - 0.3 percent, Uzbekistan - 0.3 percent and the rest of CIS states - 0.4 percent.

Within the money transfers from the EU countries, Italy accounts for the largest share of 34.9 percent, being followed by the United Kingdom (14.0 percent), Germany (13.9 percent), France (8.1 percent), Spain (3.3 percent), Ireland (3.0 percent), Poland (2.8 percent), Czech Republic (2.6 percent), Portugal (2.5 percent), Romania (2.4 percent), Belgium (2.1 percent), Cyprus (1.8 percent) and Greece (1.3 percent).

Chart no. 3. Structure of net transfers of funds from abroad to individuals by geographic areas, 2017 %

SOURCE: International banking operations statistics of the NBM

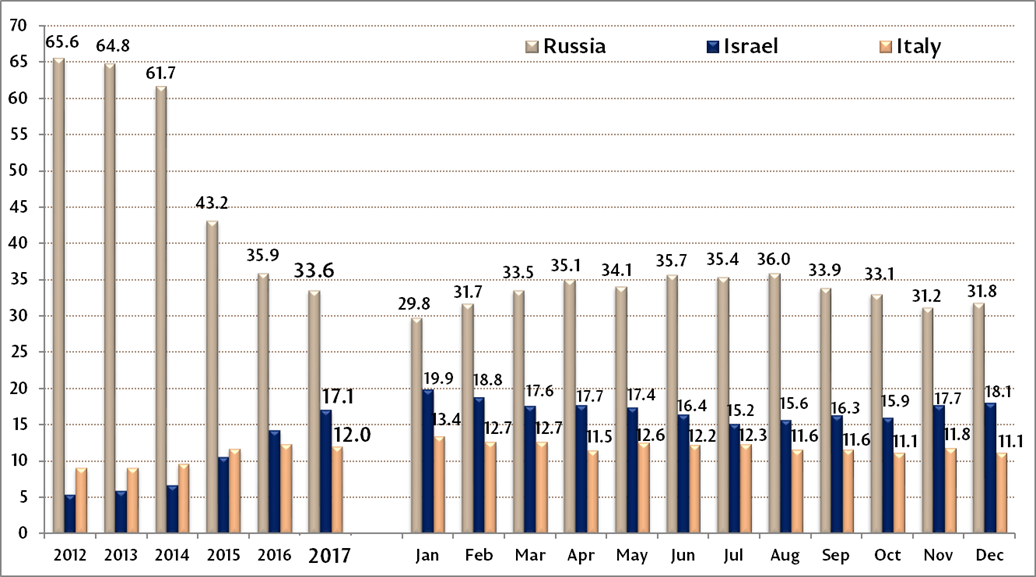

Analyzing the money transfers by country of origin, the transfers from Russia accounted for a share of 33.6 percent (402.63 million USD) of total money transfers to individuals (decreasing by 2.4 percentage points compared to 2016). It should be noted that 98.6 percent of total money transfers from Russia were made via money remittance systems. The share of money transfers from Russia (Chart no. 4) increased in January-April 2017 from 29.8 percent (USD 22.28 million) to 35.1 percent (USD 30.29 million). Increases were recorded in June, August and December, while in May, July and September - November the share dropped to 31.2 percent (USD 32.86 million).

At the same time, it should be mentioned that the money transfers from Israel - 17.1 percent (USD 205.02 million), Italy - 12.0 percent (USD 143.83 million), the US - 7.9 percent (USD 95.13 million), United Kingdom - 4.8 percent (USD 57.88 million), Germany - 4.8 percent (USD 57.56 million), France - 2.8 percent (USD 33.60 million), Turkey - 1.3 percent (USD 15.30 million) , Spain - 1.1 percent (USD 13.74 million), Ireland - 1.0 percent (USD 12.31 million), Poland - 0.9 percent (USD 11.39 million), Czech Republic - 0.9 percent (USD 10.64 million) Portugal - 0.9 percent (USD 10.33 million), Romania - 0.8 percent (USD 10.10 million), Belgium - 0.7 percent (USD 8.53 million), United Arab Emirates - 0.6 percent (USD 7.77 million), Cyprus - 0.6 percent (USD 7.43 million), Canada - 0.6 percent (USD 6.63 million), Ukraine - 0.4 percent (USD 5.28 million), Greece - 0.4 percent (USD 5.20 million) and Kazakhstan - 0.4 percent (USD 4.33 million). Money transfers from the above twenty-one countries (including Russia) account for 93.7 percent of total money transfers of the Republic of Moldova (USD 1,124.62 million).

Chart no. 4. Dynamics of money transfers (top three states) to individuals (2012 – 2017 annual; 2017 monthly), %

SOURCE: International banking operations statistics of the NBM

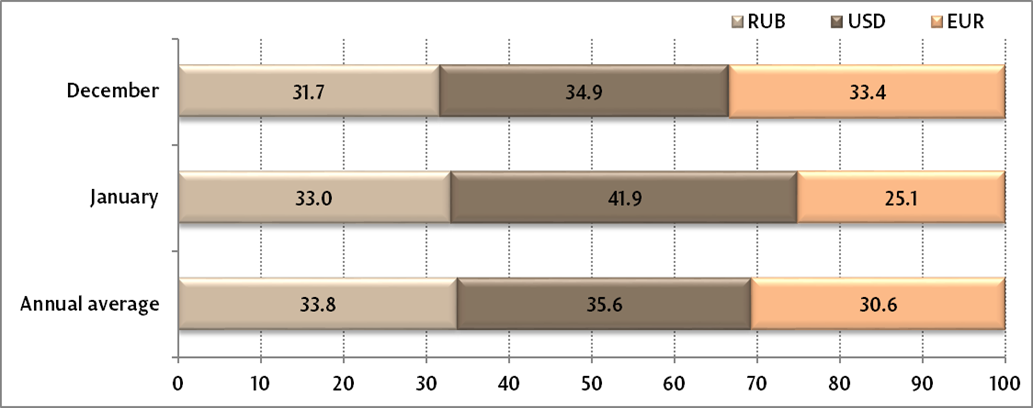

It is noteworthy that during 2012 - 2017, money transfers via money remittance systems recorded a negative correlation between the share of money transfers in USD - and RUB, while during 2017, as shown in monthly dynamics, a negative correlation was recorded between the shares of USD and EUR transfers, except for December (Chart no. 5).

Chart no. 5. Dynamics of foreign currency structure of money transfers from abroad to individuals via money transfer systems (2012 - 2017 - annual dynamics; 2017 – monthly dynamics), %

SOURCE: International banking operations statistics of the NBM

In 2017, compared to 2016, the annual currency structure of transfers via money remittance systems was characterized by a decrease of 3.8 percentage points in the share of RUB transfers, down to 9.2 percent, and an increase in the share of EUR transfers by 4.4 percentage points, up to 40.9 percent. The share of transfers in USD recorded a relatively insignificant decrease of 0.6 percentage points, up to 49.9%.

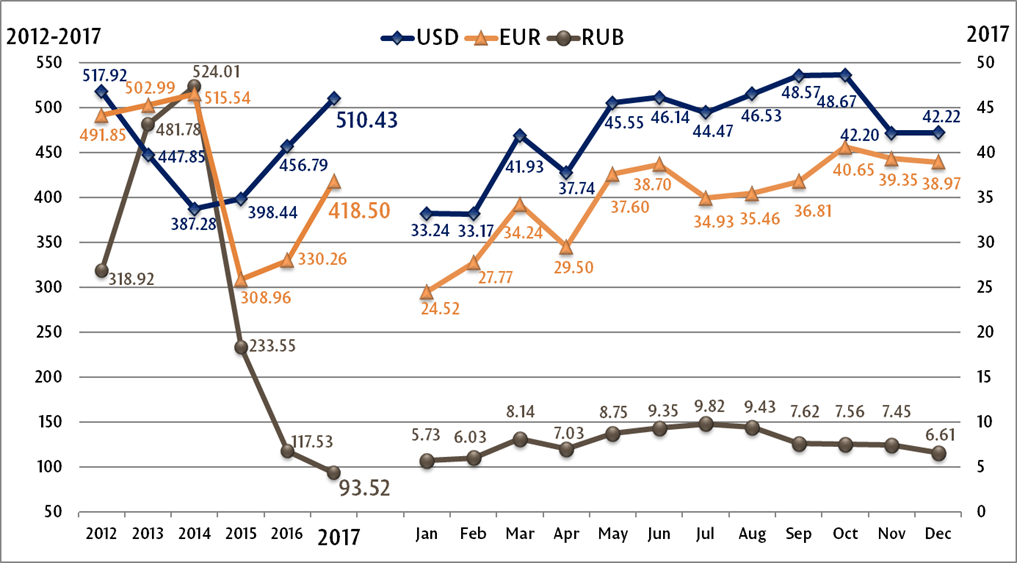

Chart no. 6. Evolution of money transfers from abroad in USD, EUR and RUB (recalculated in USD) via money remittance systems, USD million

SOURCE: International banking operations statistics of the NBM

During 2017, the volume of money transfers in USD and EUR via money remittance systems registered a positive correlation, with insignificant negative deviations in February and December (Chart no. 6).

Chart no. 7. Dynamics of foreign currency structure of money transfers from the Russian Federation via money transfer systems, recalculated in USD, in 2017, %

SOURCE: International banking operations statistics of the NBM

In 2017, the currency structure of transfers from Russia (Chart no. 7) via money remittance systems, on annual average (recalculated in USD) was as follows: money transfers in USD - 35.6 percent, in RUB - 33.8 percent and in EUR - 30.6%.

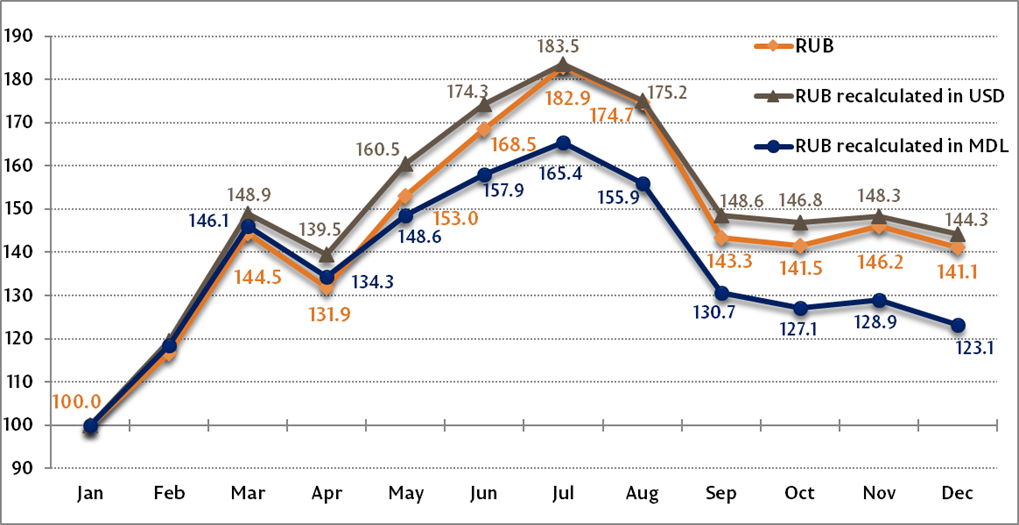

The changes in the currency structure of transfers via money remittance systems in 2017 reflect both the quantitative decreases of transfers in RUB (e.g. in April, July - October, December) and the impact of the constant appreciation of the RUB against the USD (Chart no. 8).

Chart no. 8. Evolution of money transfers in RUB via money transfers systems from the Russian Federation, recalculated in USD and in MDL, in 2017, % (January=100%)

SOURCE: International banking operations statistics of the NBM

During 2017, the Russian ruble depreciated by 10.4 percent against the Moldovan MDL, thus generating a decrease in the value of money transfers recalculated in MDL.

NOTE:

Net settlements represent data on transfers via money remittance systems, based on clearing between the system and the licensed bank (balance inflows and outflows), and account for 85.2 percent of total transfers.

The National Bank of Moldova draws attention to the fact that the money transfers from abroad to individuals via banks do not consist only of remittances sent by Moldovan labor migrants, but also include unilateral money transfers such as:

The money transferred from abroad to individuals via Moldovan banks include also money transfers received, both via money remittance systems and postal orders, at post offices of the State Enterprise "Poșta Moldovei" (settled via banks).

It should be noted that this indicator does not include:

a) international transfers performed via SWIFT payment system (with significant values) to individuals for investment purposes, which amounted to USD 14.44 million in 2017;

b) international transfers via SWIFT payment system to non-resident individuals, who are clients of Moldovan licensed banks;

c) transfers made via banks located in the Transnistrian region of the Republic of Moldova.

Publication of data is only allowed if a reference to this page is provided.