Welcome to the official website of the National Bank of Moldova!

×

Do you have good eyesight and want to turn this tool off?

Welcome to the official website of the National Bank of Moldova!

You can choose one of the most popular reports from the list:

In the first quarter of 2018, the total amount of money transfers from abroad made in favour of individuals of the Republic of Moldova amounted to USD 297.45 million. It should be mentioned that a share of 83.8 percent of money transfers was carried out via money transfer systems (only in USD, EUR and RUB) without opening bank accounts, while the rest - via bank transfers (in various currencies).

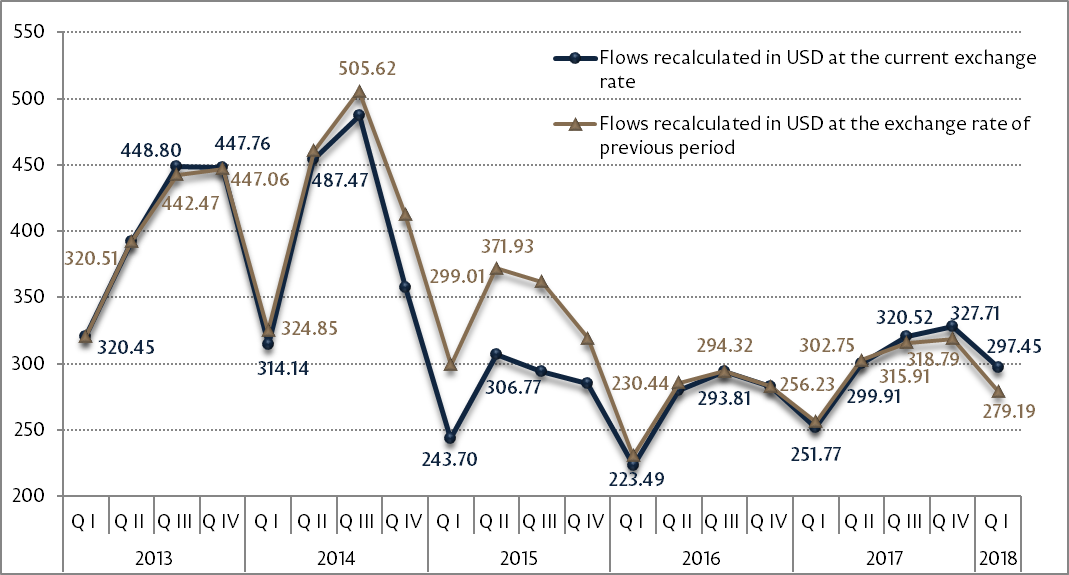

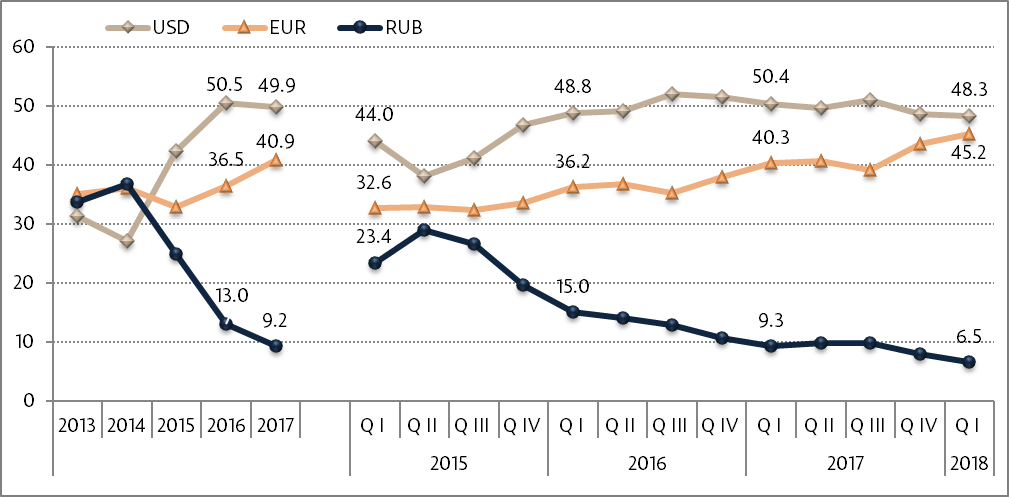

In the first quarter of 2018, the amount of transfers, recalculated in USD, increased by 18.1 percent, compared to the first quarter of 2017 (USD 251.78 million). The fluctuations in the exchange rate of original currencies against the U.S. dollar (Chart no.1) contributed by 7.2 percentage points to the increase in the value of transfers in the first quarter of 2018. However, the effective increase of transfers was 10.9 percent, being eliminated the exchange rate effect through the recalculation of amounts at the exchange rate for the respective period of the previous year. This occurred as a result of the impact of decrease in transfers in RUB by 18.3 % and the increase in transfers in EUR and USD by 31.8 percent and 12.3 percent, respectively. Thus, in the first quarter of 2018, the currency structure of transfers (recalculated in USD) was the following: USD - 136.82 million, EUR - 141.09 million, RUB - 16.43 million and other currencies 3.11 million. Chart no. 1 shows the impact of the USD/EUR and USD/RUB exchange rate’s modification on the volume of monthly transfers in favour of individuals.

Chart no. 1. The evolution of USD/EUR and USD/RUB exchange rate impact on transfers in 2013 - 2018 years (US$ mil.)

SOURCE: International banking operations statistics of the NBM

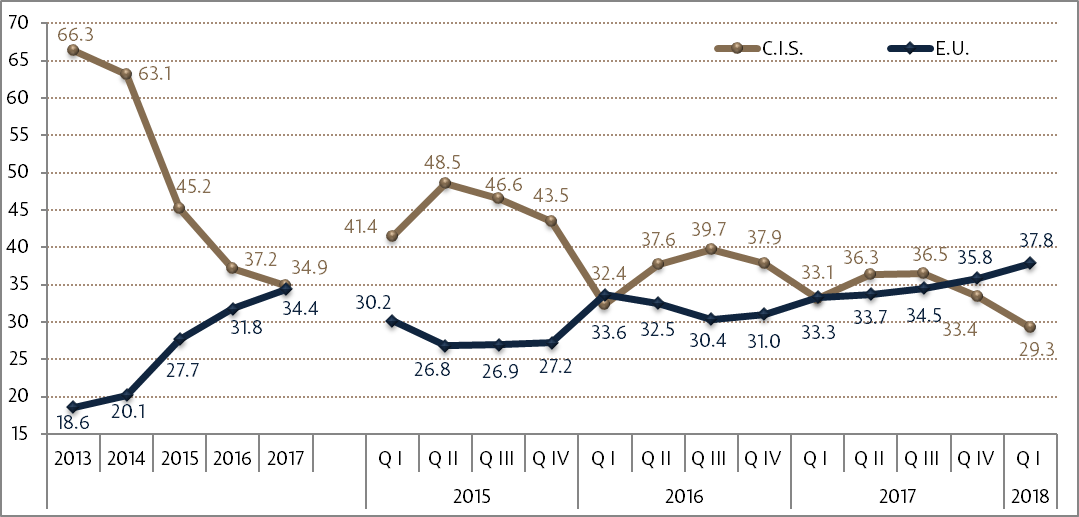

In terms of the geographical origin of money transfers from abroad in favour of individuals, the CIS and the EU are to be mentioned as the main areas generating remittances (Chart no.2). Money transfers from the CIS region accounted for a share of 29.3 percent, having decreased by 3.8 percentage points compared to the first quarter of 2017. Money transfers from EU held a share of 37.8 percent, having increased by 4.5 percentage points compared to the first quarter of 2017. The transfers from other countries, excepting the CIS and EU, accounted for 32.9 percent in the first quarter of 2018 and 33.6 percent in the first quarter of 2017, respectively. In the first quarter of 2018 and 2017, the share of transfers from Israel, USA and Turkey recorded 87.3 and 85.4 percent, respectively, of total transfers from other countries.

Chart no. 2. Dynamics of transfers from the CIS and EU in favour of individuals, (2013-2017 - annual dynamics; 2015-2018 – quarterly dynamics), %

SOURCE: International banking operations statistics of the NBM

Money transfers from the Russian Federation held the largest share of 96.4 percent of total transfers from the CIS. Transfers from other CIS countries had the following shares: Ukraine - 1.5 percent, Kazakhstan - 0.9 percent, Belarus - 0.3 percent, Azerbaijan - 0.3 percent, Uzbekistan - 0.3 percent and other CIS countries - 0.3 percent.

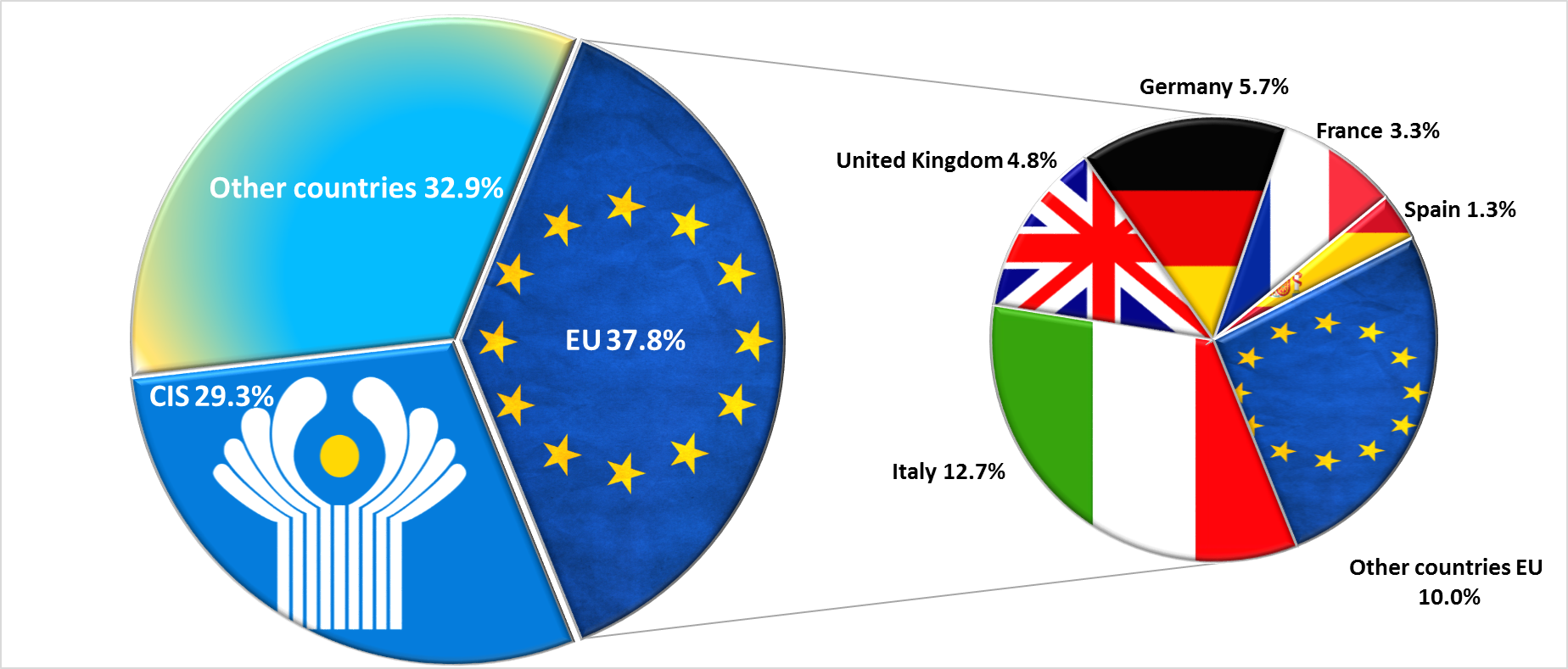

Among the transfers from the EU, transfers from Italy held the largest share of 33.7 percent, being followed by transfers from Germany (15.2 percent), United Kingdom (12.7 percent), France (8.6 percent), Spain (3.5 percent), Ireland (3.0 percent), Romania (3.0 percent), Czech Republic (2.7 percent), Portugal (2.5 percent), Poland (2.3 percent), Cyprus (2.0 percent), Belgium (1.9 percent) and Greece (1.3 percent).

Chart no. 3. Geographical structure of money transfers (main countries) in favour of individuals in the first quarter of 2018, %

SOURCE: International banking operations statistics of the NBM

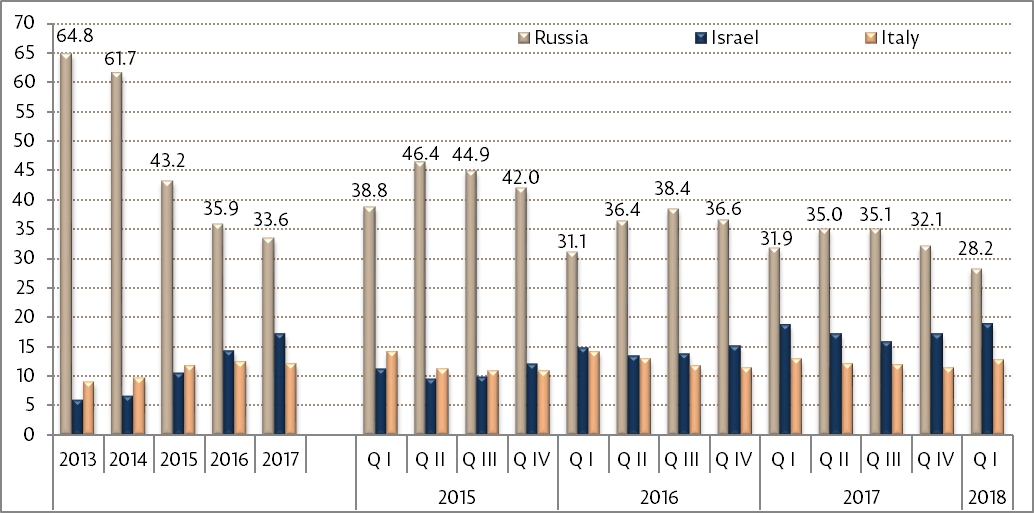

The distribution by countries of money transfers from abroad in favour of individuals (Chart no.3) showed that the Russian Federation held the share of 28.2 percent (USD 83.87 million) of total transfers (having decreased by 3.7 percentage points as compared to the first quarter of the previous year). It should be noted that 98.6 percent of total transfers from the Russian Federation were carried out through money transfer systems, the remaining 1.4 percent of transfers being performed as bank transfers via SWIFT. At the same time, the transfers from Israel recorded 18.9 percent (USD 56.22 million), from Italy - 12.7 percent (USD 37.89 million), USA – 8.0 percent (USD 23.75 million), Germany - 5.7 percent (USD 17.09 million), United Kingdom – 4.8 percent (USD 14.29 million), France - 3.3 percent (USD 9.70 million), Turkey - 1.9 percent (USD 5.55 million), Spain - 1.3 percent (USD 3.90 million), Romania - 1.1 percent (USD 3.33 million), Czech Republic - 1.0 percent (USD 3.06 million), Portugal – 0.9 percent (USD 2.78 million), Poland - 0.9 percent (USD 2.64 million), Cyprus - 0.8 percent (USD 2.22 million), Belgium - 0.7 percent (USD 2.17 million), Canada - 0.6 percent (USD 1.64 million), United Arab Emirates - 0.5 percent (USD 1.59 million), Ukraine - 0.4 percent (USD 1.29 million), and Kazakhstan - 0.3 percent (USD 0.78 million) should be noted. The transfers from the above nineteen countries (including Russia) amounted for 92.0 percent of total transfers to the Republic of Moldova (273.76 USD million).

Chart no. 4. Dynamics of transfers (top three countries) in favour of individuals (2013-2017 - annual dynamics; 2015-2018 – quarterly dynamics), %

SOURCE: International banking operations statistics of the NBM

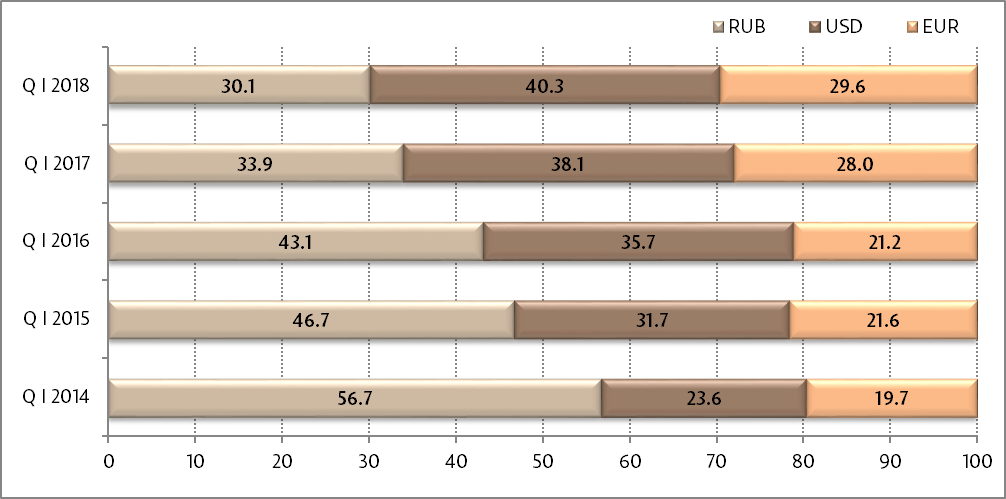

In the first quarter of 2018, as compared to the same period of the previous year, the annual currency structure of transfers via MTS showed an increase in the share of EUR transfers and a decrease in the shares of RUB and USD transfers (Chart no.5).

Chart no. 5. Currency structure of money transfers from abroad in favour of individuals via money transfer systems (2013-2017 - annual dynamics; 2015-2018 – quarterly dynamics), %

SOURCE: International banking operations statistics of the NBM

The quarterly share of transfers in RUB via MTS recorded a steady downward trend, having decreased from 23.4 percent in the first quarter of 2015 to 6.5 percent in the first quarter of 2018. The share of transfers in USD recorded an upward trend during the same period. The quarterly share of transfers in EUR (recalculated in USD) increased by 4.9 percentage points, to 45.2 percent, while the quarterly share of transfers in USD and RUB (recalculated in USD) decreased by 2.1 percentage points, to 48.3 percent, and by 2.8 percentage points, to 6.5 percent, respectively.

Chart no. 6. Currency structure of money transfers via money transfer systems from the Russian Federation, recalculated in USD, in the first quarter of the years 2014 - 2018, %

SOURCE: International banking operations statistics of the NBM

In the first quarter of 2018, within the currency structure of money transfers from the Russian Federation (Chart no.6) via MTS, on quarterly average (recalculated in USD), the transfers in USD were predominant (40.3 percent), followed by the transfers in RUB with a share of 30.1 percent and transfers in EUR – 29.6 percent. In the first quarter of 2014-2018, it was noted a downward trend of transfers in RUB from 56.7 percent to 30.1 percent of total per currency and an increase of transfers in USD and in EUR from 23.6 percent to 40.3 percent, respectively, from 19.7 percent to 29.6 percent.

NOTE:

The National Bank of Moldova notes that money transfers from abroad in favour of individuals via banks do not consist solely of remittances of Moldovan citizens working abroad, but also include unilateral transfers such as:

Money transfers from abroad in favour of individuals through Moldovan banks also include transfers of individuals made via postal offices of the State Enterprise "Poşta Moldovei" (settled through banks), both via MTS and money orders.

Note that this indicator does not include:

a) international transfers to individuals made via SWIFT payment system with an investment purpose (with significant values), which amounted to USD 3.55 million in the first quarter of 2018;

b) international transfers via SWIFT payment system to non-resident individuals, clients of licensed Moldovan banks;

c) transfers made via banks located in the Transnistrian region of the Republic of Moldova.

Publication of data is only allowed if a reference to this page is provided.